Marginal tax rate calculator

Your income puts you in the 10 tax bracket. Your marginal tax rate This calculator can also be used as an Australian tax return calculator.

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

0 would also be your average tax rate.

. Discover Helpful Information And Resources On Taxes From AARP. Find out your tax brackets and how much Federal and Provincial. Your income puts you in the 10 tax bracket.

This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Average tax rate 000 Marginal tax rate 000 Summary Please enter your income deductions gains dividends and taxes paid to get a summary of your results.

0 would also be your average tax rate. Your Federal taxes are estimated at 0. Note that it does not take into account any tax rebates or tax offsets you may be entitled to.

This is 0 of your total income of 0. 2020 Marginal Tax Rates Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. Your income puts you in the 10 tax bracket.

Personal tax calculator. Free income tax calculator to estimate quickly your 2021 and 2022 income taxes for all Canadian provinces. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Calculate the tax savings. Calculate your combined federal and provincial tax bill in each province and territory. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 0 would also be your average tax. 0 would also be your average tax rate.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. 2016 Marginal Tax Rates Calculator. Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income.

Marginal Tax Rate Calculator Knowing your income tax rate can help you calculate your tax liability for unexpected income retirement planning or investment income. At higher incomes many deductions and many credits are phased. This is 0 of your total income of 0.

This is 0 of your total income of 0. At higher incomes many deductions and many credits are phased. 2021 Marginal Tax Rates Calculator.

Cost Of Debt Kd Formula And Calculator Excel Template

Excel Formula Income Tax Bracket Calculation Exceljet

How And Why To Calculate Your Marginal Tax Rate Deliberatechange Ca

Payback Period Formula And Calculator Excel Template

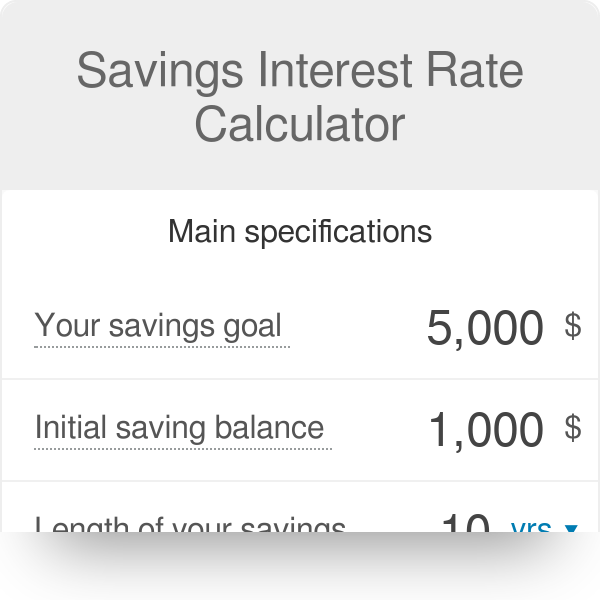

Savings Interest Rate Calculator

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Net Profit Margin Formula And Ratio Calculator Excel Template

Marginal And Average Tax Rates Example Calculation Youtube

:max_bytes(150000):strip_icc()/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Pin On Finances Investing

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Marginal Tax Rate Formula Definition Investinganswers

Payback Period Formula And Calculator Excel Template

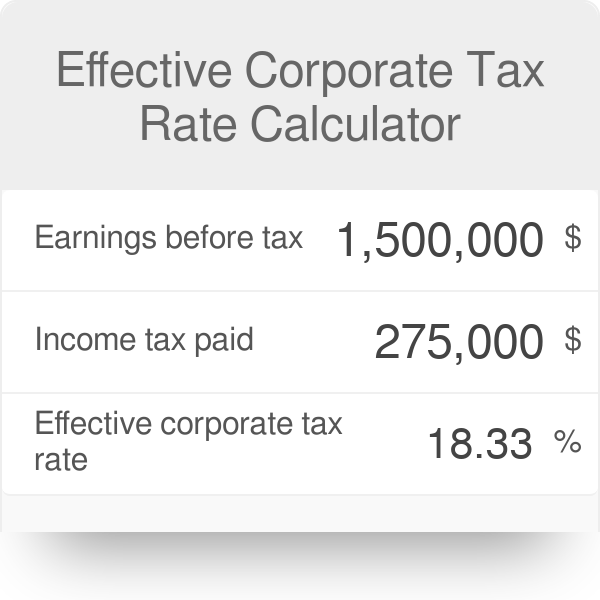

Effective Corporate Tax Rate Calculator

Return On Equity Roe Formula And Calculator Excel Template

Income Tax Formula Excel University

Break Even Point Bep Formula And Calculator Excel Template